Capetown Capital Lenders will fund any loan from our Georgia location, we may even come to you. On any jewelry equity loan greater than $100,000, our staff will make your life easier and come to you. Recently, we sent our vice president to a borrower for a jewelry equity loan against a 4.66ct marquise diamond.

What is an equity loan?

An “equity” loan is a loan you take against your personal property, it may be against your home, vehicle, or in this case, jewelry. Keep in mind, a loan will come with the borrowing amount and a rate; the rate is a percentage of your amount borrowed that will be charged to extend the loan a certain amount of time. An equity loan has a rate that is calculated based on the amount you borrow and the worth of your property. For example, if the property used to secure an equity loan is worth $10,000 and you only borrow $7,000, your rate will be lower because your loan is more secure for the lender.

Why get a jewelry equity loan?

Similar to a home equity loan where unpaid finance charges may result in the loss of your home, a jewelry loan, if unpaid for an extended amount of time, may cause you to lose your jewelry to the lender. However, instead of evicting clients from their home, the jewelry is liquidated and sold back into the market.

Unlike home loans, jewelry equity loans are generally short-term. The finance charges that extend the loan accrue at the agreed upon rate monthly. These loans allow the borrower to take advantage of opportunities whenever they come up, and terminate the loan in a shorter amount of time.

Another great benefit to a jewelry equity loan with Capetown Capital Lenders is we do not report to credit bureaus. So your credit score will not affect your loan in any way. Also, if for some reason you cannot make payments and the loan eventually defaults, your credit score will remain the same. If a loan defaults, we simply liquidate the jewelry to recoup our loss.

Borrow money faster & easier

Capetown Capital Lenders’ loans are quick and easy because our process eliminates unnecessary paperwork by assessing loan values based on your jewelry’s worth. Bypassing credit checks, work history, financial records and other time-consuming tasks is what makes our process so quick. This is why we can fund up to $1,000,000 in as few as 24 hours!

Get a quote today

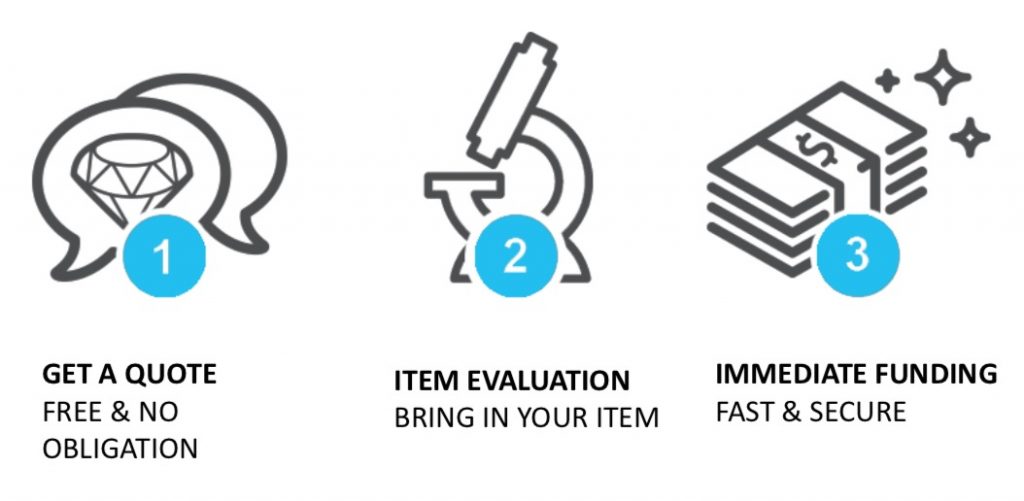

Fill out our online form with information about your jewelry or luxury watch, and any appraisal or certification paperwork. We’ll evaluate your item and give you a quote the same day.

If you accept our offer, visit our Atlanta location or mail us your jewelry or luxury watch. We may even come to you, if your jewelry equity loan totals over $100,000! We accept jewelry from around the country and will send you a fully insured, pre-paid shipping label. Your funds will be wired directly to your bank account, once we have verified your jewelry.