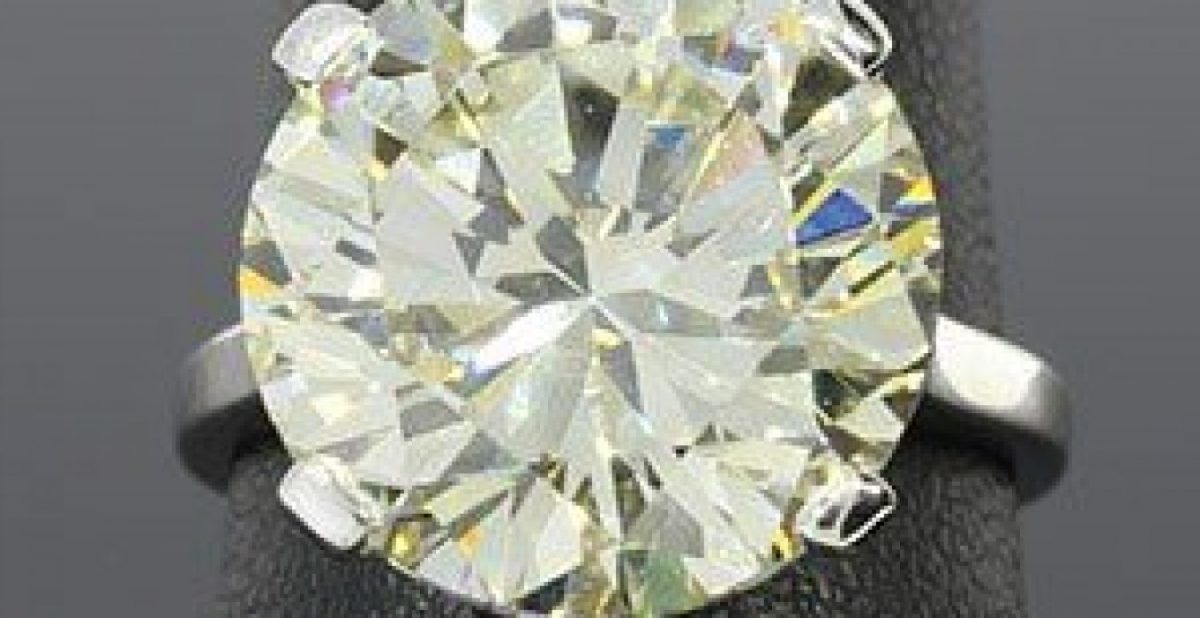

Jewelry equity loans are utilized by companies who lend their intangible assets. However, anyone can receive a jewelry equity loan with collateral like jewelry, diamonds, or luxury watches.

Added Flexibility

One benefit is that asset-based lending has relatively few restrictions on what you can spend the money. Many other types of loans come with strings attached in terms of what you can do with the loan. However, jewelry equity loans are perfect for anyone who needs fast cash. Whether you need quick cash to pay a medical bill or to kick-start a business, jewelry equity loans are for you.

Easier to Obtain Than a Typical Loan

Another added benefit of jewelry equity loans is they are fast and easy to qualify for. Jewelry equity loans also do not require outstanding credit, all you need is the jewelry. With luxury lender, Capetown Capital Lenders, all you need to do is fill out an interest form. Capetown Capital Lenders will also get back to you with a free quote within 24 hours of when you submit the form. This expedites the lending process, so you get your loan as soon as possible. Another benefit of Capetown Capital Lenders is that we do not conduct credit checks or employment verification.

A Jewelry Equity Loan Can Help You Avoid Debt

Jewelry equity loans are preferable because they can offer you a way to quickly obtain a loan without a credit check. Also, a typical loan can put you in debt if you don’t come up with the capital to pay back the loan. However, if you can’t pay back an asset-based loan, you simply lose the collateral, without putting yourself into debt. With Capetown Capital Lenders, you can pay back the loan in increments or pay in lump sums. This flexible and incremental payment process can make the loan much easier to pay back.

If you’re looking for a flexible loan that’s easy to obtain and won’t put you in debt, consider an asset-based loan. Capetown Capital Lenders is an asset-based lender committed to providing a high-quality lending experience.